2019 was a year to remember for global stock markets and AlphaTower. We managed to beat the MSCI World Index and we set-up a separately managed account approach.

Investors enjoyed a year that saw a positive return for nearly every global equity market, however this will likely not be the case in 2020 as global markets can perform quite differently over time. While many of the global stock indices were unable to record a positive performance in the first month of this year, AlphaTower achieved a 0.8% return.

Volatility

Stock markets can experience high levels of volatility affecting the value of the equities traded in those markets. The investment decisions of AlphaTower are model driven, and will be dynamically managed. The AlphaTower model is designed to identify an optimal set and combination of relevant market factors. Low volatility (one of the factors being used by AlphaTower) strategies emphasize stocks whose prices fluctuate less than those of other stocks. We prefer stocks with low market risk. We have seen a drop in equity markets the last two weeks of December, with a sizable pickup in volatility. If you want to learn how AlphaTower is performing during volatile periods, please navigate to this page or download our slide deck here. We are confident that we will win more in good times and lose less in bad times.

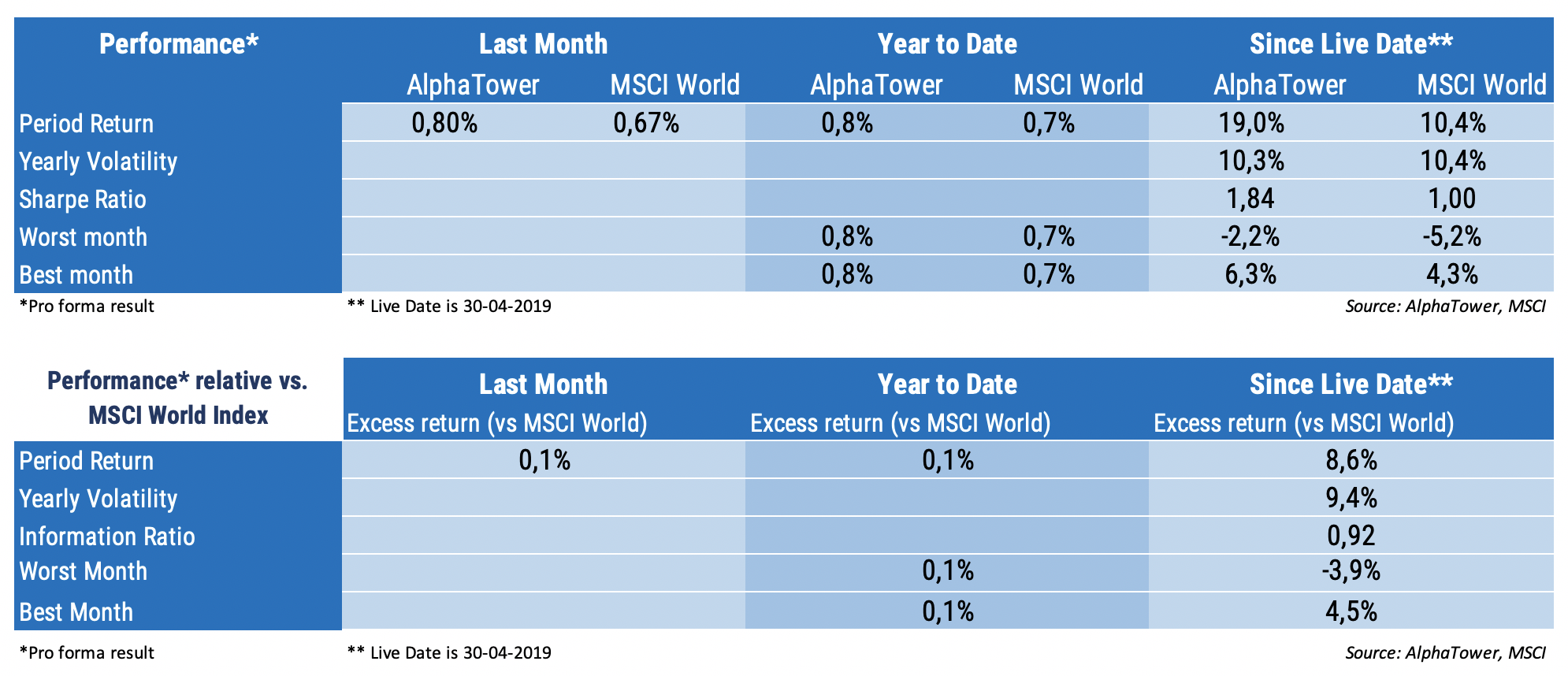

Please find the latest performance tables below. The performance chart and the return-tables have been updated.

February 2020!

If you want to learn about our February 2020 results, please leave your e-mail address and we will let you know.